The Clarity Mandate: Healthtech 2025 Demands Proof Over Promise

Nov 5, 2025

Healthtech is finding its rhythm again.

After the unprecedented surge of 2021, the sector spent the next few years recalibrating. Fundraising flattened as investors, wary of scaling clinical innovation, shifted focus from speculative bets to measurable ROI.

Now, in 2025, momentum is returning in a more grounded, more disciplined form. The focus has decisively moved toward operational and administrative solutions: revenue cycle, billing, coding, and documentation tools that work inside the walls of healthcare. Adoption is rising and buying cycles are shortening because these solutions deliver immediate, measurable value.

Yet this new phase introduces a different kind of friction. Capital is flowing toward pre-validated products faster than adoption can keep pace. Investor activity, founder sentiment, and buyer behavior are moving at different speeds. As Rock Health noted in the Q3 2025 market overview, the “signals are out of sync,” an issue Silicon Valley Bank captures bluntly in The Future of HealthTech 2025 report: capital has moved faster than validation.

For many early-stage founders, 2025 presents a paradox: you have secured the funding, but the proof is still in progress.

The opportunity is clear: the challenge is no longer raising more capital, but proving adoption, scaling what works, and building for staying power.

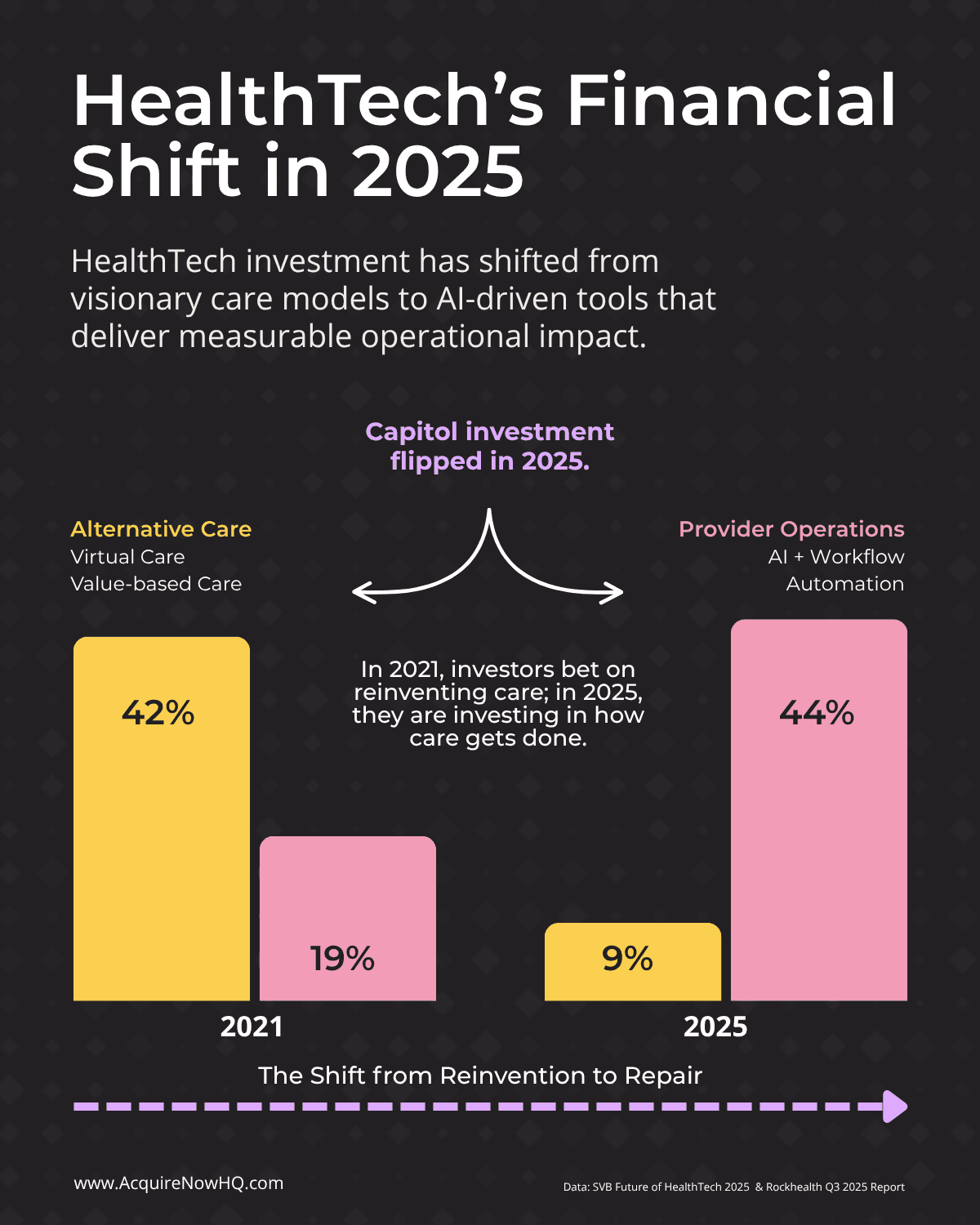

The Financial Shift to Provider Operations

In 2021, much of the energy and capital flowed into alternative and value-based care (VBC) models that promised to reinvent healthcare delivery. Those bets expanded what was possible, but they also revealed how hard transformation is when reimbursement, data, and workflows do not align.

By 2025, SVB reports that alternative care (including VBC) had dropped to just 9% of total sector investment, as investors recalibrated toward clearer near-term returns in infrastructure and automation.

Today, nearly half of all new funding targets provider operations, including billing, scheduling, documentation, and workflow automation. These areas now account for 44% of total sector investment.

This reallocation signals a structural shift. The most immediate value of AI in healthcare lies in solving business inefficiencies, not clinical ones. Hospitals and health systems under pressure to do more with less see measurable impact in tools that streamline denials, accelerate reimbursement, and improve documentation.

As SVB notes,

The AI boom has been good to provider operations.

The next wave of healthtech is not about changing medicine. It is about changing how medicine gets done.

From Hype to Trusted Administrative AI

AI is no longer the story; it is the setting.

Adoption is rising even as enthusiasm cools. Health systems are embracing AI for documentation, coding, and revenue cycle management while staying cautious about diagnostic or decision-support tools.

That caution is not resistance; it is realism. The sector has learned that speed without reliability creates risk, and in healthcare, reliability is everything. The companies that win in this next phase will not only show what their AI can do but also prove what it can be trusted to do.

Trust, not technical sophistication, will be the defining differentiator. Operationalizing trust through validation, compliance, and transparency will separate enduring platforms from experimental tools. In this market, evidence is strategy.

The Ecosystem and Long-Term Value

While the IPO window remains narrow, strategic consolidation is rapidly reshaping the landscape. This activity signals a broader redefinition of value: innovation alone no longer commands a premium; integration does.

The core driver of this market is the need for platform-level cohesion. Acquirers like UnitedHealth, CVS, and Boston Scientific are specifically targeting platforms that improve workflow efficiency and data connectivity, proving that system strength is the new measure of worth.

Founders are better positioned when they design for interoperability and seamless ecosystem fit from day one to be positioned for long-term outcomes. The smarter question now isn’t just “Who will buy this?” but “How does this make an existing system stronger?”

Reframing AI's Value

Amid all the talk of operational automation, the human story remains at the center. Workforce shortages continue to strain healthcare delivery, forcing organizations to rethink how technology supports rather than replaces clinicians. Buyers are reframing technology purchases as labor investments instead of innovation bets. As Julie Yoo, General Partner at a16z put it:

These aren’t pilots or test cases anymore. For a lot of buyers, it’s not even a technology purchase, really. There are shortages of physicians, nurses, revenue cycle specialists. People are saying ‘What if we took a portion of what we have budgeted for these positions, and spent it on tech that lets us increase productivity for the staff we actually have?’ They’re looking at this as a labor purchase more than anything else.

This insight reframes the role of AI. The most resonant message today is not “AI replaces clinicians,” but “AI gives clinicians time back.” Efficiency, in this context, becomes an act of empathy and a competitive differentiator for solutions designed with human limits in mind.

The Founder's Urgency Dilemma

2025 funded a new category of technology, the opportunity over maturity, leading many pre-Seed to Series A startups to raise capital before achieving repeatable revenue (adoption).

Consequently, those same teams are now under acute pressure to scale activities (hiring, marketing, and product expansion) all based on validation that hasn’t yet arrived.

The reality is clear: scaling without GTM-fit is a recipe for failure.

The real test is not raising money. It is customer proof. Founders must move beyond investor validation to focus on adoption, retention, and replicable patterns of growth. Those who succeed will do so by aligning speed with evidence and ambition with discipline.

Clarity as Competitive Advantage

Clarity is more than communication. It is strategic advantage.

In a market where funding is stable, adoption is steady, and the bar for impact is higher, clarity allows founders to focus on what truly matters: proving what works, scaling what matters, and building for staying power.

The healthcare sector has issued its mandate. Answering it requires trading noise for nuance and pursuing strategic clarity.

Founders and operators who pair rigor with focus embrace three core principles of strategic clarity:

Validation Clarity: Base growth on rigorous evidence, not assumptions.

Positioning Clarity: Sell outcomes—time, efficiency, trust—not technology.

Ecosystem Clarity: Design for integration and interoperability to strengthen existing systems, not disrupt them.

In a market that demands proof, scale, and staying power, those who act with strategic clarity will shape the future of healthcare.